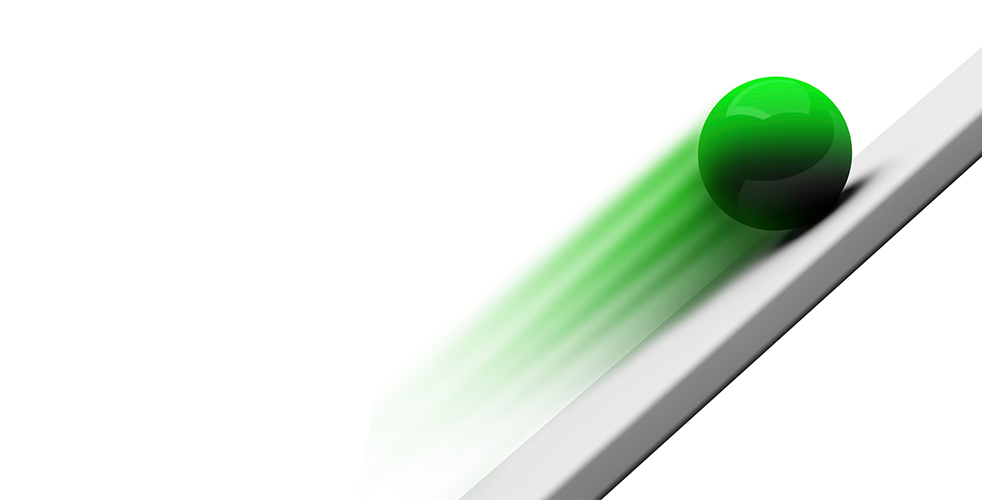

What is Momentum and Why Does it Work?

The concept of momentum originated with regard to classical mechanics, in which it refers to the tendency of a moving object to keep moving along its direction of travel. In finance, and especially with regard to investing, we talk in terms of price momentum. As you can infer, this is the tendency for asset prices to continue moving in the same direction they are currently heading.